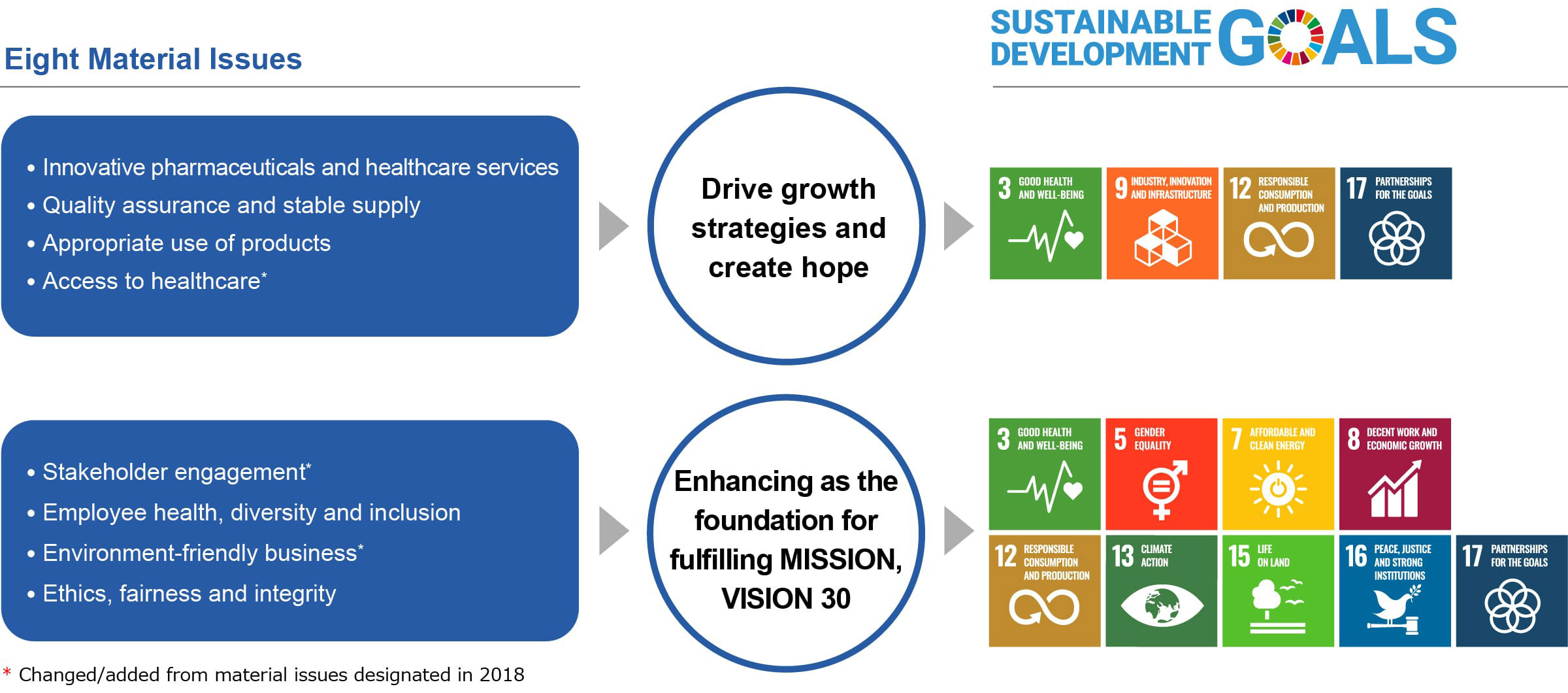

The Tanabe Pharma Group believes that using our business to provide value to society and contribute to a sustainable society is integral to our corporate survival and growth. To clarify this belief and strengthen our efforts along those lines, in fiscal 2018, following the process outlined below, we identified material issues that our Company is positioned to actively address. Since then, however, the social and environmental issues have become more pressing, and the demands of society have accordingly changed.

Recognizing the changes, we looked back at our achievements and forward to the future of healthcare, and reevaluated the role that Tanabe Pharma should play in the society of the future. This reevaluation led us to recast our corporate philosophy into our MISSION and our vision into VISION 30. As part of these efforts, we identified the following eight items as new materialities from the perspective of what is important in helping to realize a sustainable society.

In designating material issues, the Group considered not only international guidelines and GRI standards but also SASB*1 pharmaceutical industry evaluation standards, ATM index*2 evaluation items, and others. In this way, social issues that need to be considered were identified in a comprehensive manner.

- Sustainability Accounting Standards Board. An NPO based in the U.S. that sets and discloses sustainability evaluation standards by industry. In 2021, it was integrated with the IIRC to establish the Value Reporting Foundation (VRF).

- Access to Medicine Index. An index that analyzes and ranks 20 of the world’s top pharmaceutical companies on how they make medicines more accessible. Implemented by the Access to Medicine Foundation, an NPO based in the Netherlands.

For the social issues identified in step 1, their importance for the Group was evaluated with consideration for such factors as the Group’s values and major policies, strategies and specific activity objectives, and risk-related information.

In addition, to evaluate the importance of these issues for stakeholders, we analyzed and organized items that are considered to be important by evaluation institutions that work to promote responsible investing on behalf of external stakeholders. From these two perspectives, we created a materiality map and narrowed down the issues to those with high priority.

We designated the material issues after the validity of the materiality map was confirmed through consultation with experts from inside and outside the Company. For the material issues, we organized and confirmed their relevance in regard to major initiatives and the SDGs.

The Group has established monitoring indicators to track the status of materiality initiatives and bring about further improvements. Following a review of materiality, we have established the monitoring indicators shown below. The results of the new monitoring indicators are disclosed beginning with the fiscal 2021 results.

Please click the link to see initiative examples.

sdgs03e sdgs09e

|

Main Initiatives and Results |

||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2021 |

Scope of data collection |

||

|

Creating new drugs, adding indications, changing dosage and administration, adding formulations, and providing around the pill solutions |

Number of approvals (Medium-Term Management Plan 21–25, cumulative) |

35 |

29 |

24*4 |

13 |

(Global) |

|

Number of solutions provided to patients (Medium-Term Management Plan 21–25, cumulative) |

6 |

5 |

3 |

0 |

(Global) |

|

|

Number of development pipelines |

16 |

17 |

20 |

27 |

(Global) |

|

|

Awards received for drug discovery (total since 2007 merger) |

22 |

22 |

21 |

21 |

(Global) |

|

|

Number of partnering projects (Medium-Term Management Plan 21–25, cumulative) |

19 |

15 |

11 |

6 |

(Global) |

|

|

Medium-Term Management Plan 21–25 new product sales volume by year |

|

|

|

|

(Global) |

|

- Initiative examples:

sdgs03e sdgs12e

|

Main Initiatives and Results |

||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2021 |

Scope of data collection |

||

|

Building systems for the stable supply of reliable pharmaceuticals, and appropriate responses to questions about quality |

Number of product recalls (class I, II, and III) |

Class I 0 Class II 0 Class III 0 |

Class I 0 Class II 2 Class III 0 |

Class I 0 Class II 1 Class III 0 |

Class I 0 Class II 1 Class III 0 |

(Japan) |

|

Customer satisfaction with questions about quality |

93.5% |

91.2% |

92.9% |

92.4% |

(Japan) |

|

- Initiative examples:

sdgs03e sdgs12e

|

Main Initiatives and Results |

||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2021 |

Scope of data collection |

||

|

Establishing a drug consultation center, collecting safety information, and providing information related to the appropriate use of products |

Number of external presentations on clinical research (papers/academic conferences, etc.) |

156 |

105 |

84 |

77 |

(Global) |

|

Instances of safety information collected |

Domestic: 22,450 Overseas: 39,401 |

Domestic: 22,893 Overseas: 42,393 |

Domestic: 20,200 Overseas: 49,600 |

Domestic: 14,600 Overseas: 54,100 |

(Global) |

|

- Initiative example:

sdgs03e sdgs09e sdgs17e

|

Main Initiatives and Results |

||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2021 |

Scope of data collection |

||

|

Supporting patients, developing therapeutic drugs for intractable and rare diseases, promoting projects for infectious diseases that are prevalent in developing countries |

Number of subsidized patient organizations (cumulative, total) |

352 |

282 |

219 |

167 |

(Global) |

|

Number of health support website visitors |

21.95 million |

20.46 million |

24.25 million |

31.44 million |

(Global) |

|

|

Number of pipelines for intractable and rare diseases |

11 |

8 |

8*4 |

9 |

(Global) |

|

|

Number of approvals for intractable and rare diseases (Medium-Term Management Plan 21–25) |

4 |

4 |

4*4 |

1 |

(Global) |

|

|

Number and stage of infectious disease treatment projects for developing countries |

3 (Non-clinical) |

3 (Non-clinical) |

3 (Non-clinical) |

2 (Non-clinical) |

(Global) |

|

|

Number of health support programs in developing countries |

Vaccine: 11,881 doses |

Vaccine: 11,335 doses |

Vaccine: 9,281 doses |

Vaccine: 34,633 doses |

(Global) |

|

- Initiative example:

sdgs12e

|

Main Initiatives and Results |

||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2021 |

Scope of data collection |

||

|

Disseminating information and dialoging with stakeholders including customers, the general public, and employees |

Employee awareness survey results (Sympathy/understanding of management philosophy, rewarding/motivation) |

73% |

77% |

77% |

79% |

(Global) |

|

Customer satisfaction survey results (7-point scale) |

Overall satisfaction: 5.17 |

Overall satisfaction: 5.00 |

Overall satisfaction: 5.11 |

Overall satisfaction: 5.05 |

(Japan) |

|

- Initiative examples:

sdgs03e sdgs05e sdgs08e

|

Main Initiatives and Results |

||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2021 |

Scope of data collection |

||

|

Promoting health management and improving work environment where all employees can play an active role |

Employee survey results (Wellness item) |

84% |

85% |

84% |

85% |

(Global) |

|

Employee survey results (Diversity and respect for individuals) |

80% |

81% |

79% |

81% |

(Global) |

|

|

Diversity of management |

25.0%*5 |

25.0%*5 |

10.0% |

20.8% |

(Global) |

|

- Initiative examples:

sdgs07e sdgs13e sdgs15e sdgs17e

|

Main Initiatives and Results |

||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2021 |

Scope of data collection |

||

|

Reducing environmental impact in corporate activities and educating employees to raise environmental awareness |

GHG emissions (vs. fiscal 2019) |

35.0% reduction |

34.0% reduction*2 |

28.7% reduction*2 |

18.1% reduction*2 |

(Global) |

|

Amount of water withdrawal (vs. fiscal 2019) |

44.6% reduction |

38.2% reduction*2 |

37.6% reduction*2 |

31.1% reduction*2 |

(Global) |

|

|

Amount of final waste disposed (vs. fiscal 2019) |

78.2% reduction |

70.8% reduction*2 |

52.8% reduction |

1.1% reduction |

(Japan) |

|

- Initiative examples:

sdgs12e sdgs16e

|

Main Initiatives and Results |

||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2021 |

Scope of data collection |

||

|

Working to cultivate an awareness of compliance issues, establishing and observing a variety of policies, and establishing hotlines |

Surveying employee awareness on compliance (Employee awareness survey / 5 points is a perfect score) |

96% |

96% |

95% |

4.51 points |

(Global) |

|

Customer satisfaction survey results (7-point scale) |

Compliance: 5.29 |

Compliance: 5.09 |

Compliance: 5.15 |

Compliance: 5.14 |

(Japan) |

|

- Initiative examples:

- Total favorable is the total score of the top two response choices (Agree/Tend to Agree).

- Due to some calculation omissions and a review of calculation coefficients, results from FY2019 onwards have been amended.

- In accordance with changes to survey methods, FY2022 results and the scope of the survey have also changed.

- FY2022 results were revised to account for some omissions and for revisions to aggregation methods.

- Due to a reorganization of overseas consolidated companies, the companies targeted for aggregation were revised.